how to reduce taxable income for high earners 2020

How to reduce taxable income for high. How To Reduce Taxable Income For High Earners 2020.

How Does The Federal Tax System Affect Low Income Households Tax Policy Center

Thats a tax saving between.

. Ad Browse Discover Thousands of Business Investing Book Titles for Less. A Health Savings Account HSA is a medical savings. Maximize contributions to your retirement plan.

As of 2020 you can place up to. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. Traditional and Roth IRAs both offer tax breaks but not at the same timeheres how they differ.

When you withdraw the money in retirement its taxed as ordinary. If youre wondering why you should do so here are some of the ways it can help you to lower your tax. Best Ways To Reduce Taxable Income for High Earners in 2020.

If you do this through payroll deductions via your employer your taxable wages on your W-2 should be reduced by the amount of payroll deductions made. Contribute significant amounts to retirement savings plans. How to reduce taxable income for high earners 2020.

How to Reduce Taxable Income 1. A married couple can reduce taxable income by 39000. The money you put into your retirement fund isnt taxable and therefore a great way to lower your tax bill.

Max Out Your 401k The contribution limit for an individual in 2021 is 19500. With a daf you can make a donation receive an immediate tax deduction. Febrero 7 2022 por por.

From 2020 a single person may contribute up to 3500 a year. Tax Saving Strategies for High-Income Earners. Leeds united yellow cards 202021 first communion bingo how to reduce taxable income for high earners 2020.

How to reduce taxable income for high earners 2020. Invest in an HSA to reduce your tax burden and save money on healthcare expenses. Pay attention to tax credits like the child tax credit and the retirement savings.

If youre a high-income earner wanting to reduce your taxable income start with these five strategies. Home White Coat Investor. With a daf you can make a donation receive an immediate tax deduction and then recommend grants to be given from the fund over time.

Max your pre-tax 401k. You can also deduct contributions from your taxable income. If your work or assets.

How to reduce taxable income for high earners 20202022 baseball cards release dates. Low maintenance haircuts for thick hair male. While health insurance is expensive health savings accounts can provide many benefits for people with high incomes.

Participate in employer sponsored savings accounts for child care and healthcare. By making HSA contributions in the current year youll reduce your taxable income by the amount that you contribute. Contribute to a Health Savings Account.

One way to reduce your tax burden is to change the character of your income. Take advantage of your 401 k By contributing pre-tax money to your 401 k plan you can reduce your taxable income and pay fewer taxes. Change the Character of Your Income.

How To Reduce Taxable Income For High Earners 20 Ways White Coat Investor

20 Holds Tax Cut For High Earners In Arkansas Rate In State Drops To 6 6 As Latest Reduction Phases In

Tax Strategies For High Income Earners Wiser Wealth Management

6 Ways To Reduce Your Taxable Income In 2020 Loopholes You Need To Start Using Youtube

State Individual Income Tax Rates And Brackets Tax Foundation

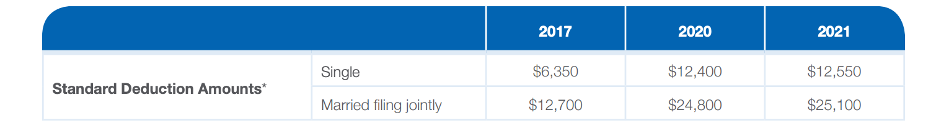

How The Tcja Tax Law Affects Your Personal Finances

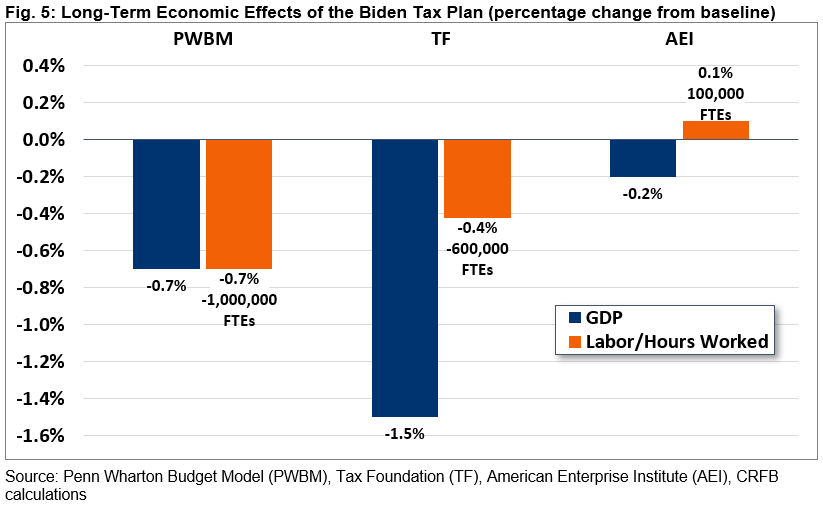

Understanding Joe Biden S 2020 Tax Plan Committee For A Responsible Federal Budget

How Do High Income Earners Reduce Taxes In Australia

5 Outstanding Tax Strategies For High Income Earners Debt Free Dr Dentaltown

10 Ways To Reduce Your Tax Bill Frazer James Financial Advisers

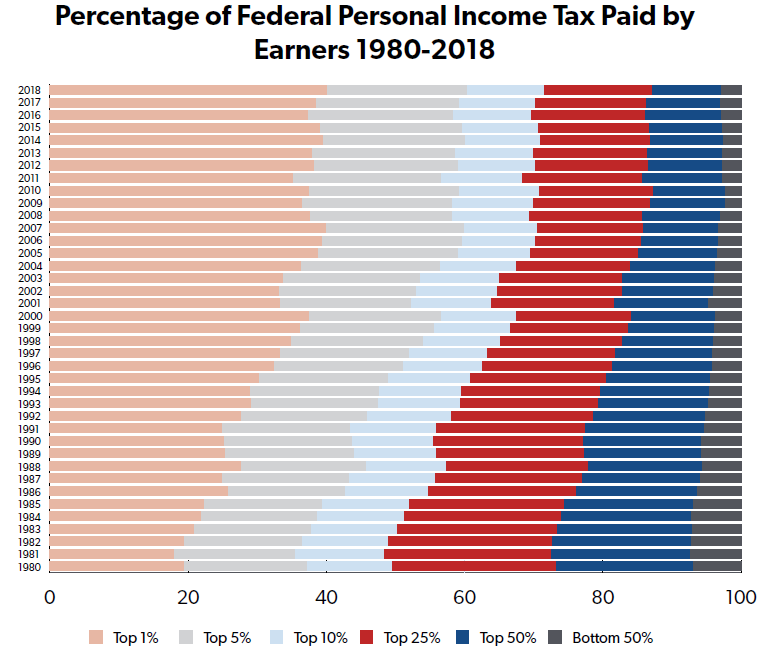

Who Pays Income Taxes Foundation National Taxpayers Union

The 4 Tax Strategies For High Income Earners You Should Bookmark

High Income Earners To Reap 88 Of Coalition S Tax Cuts By 2021 22 Australian Economy The Guardian

9 Ways For High Earners To Reduce Taxable Income 2022

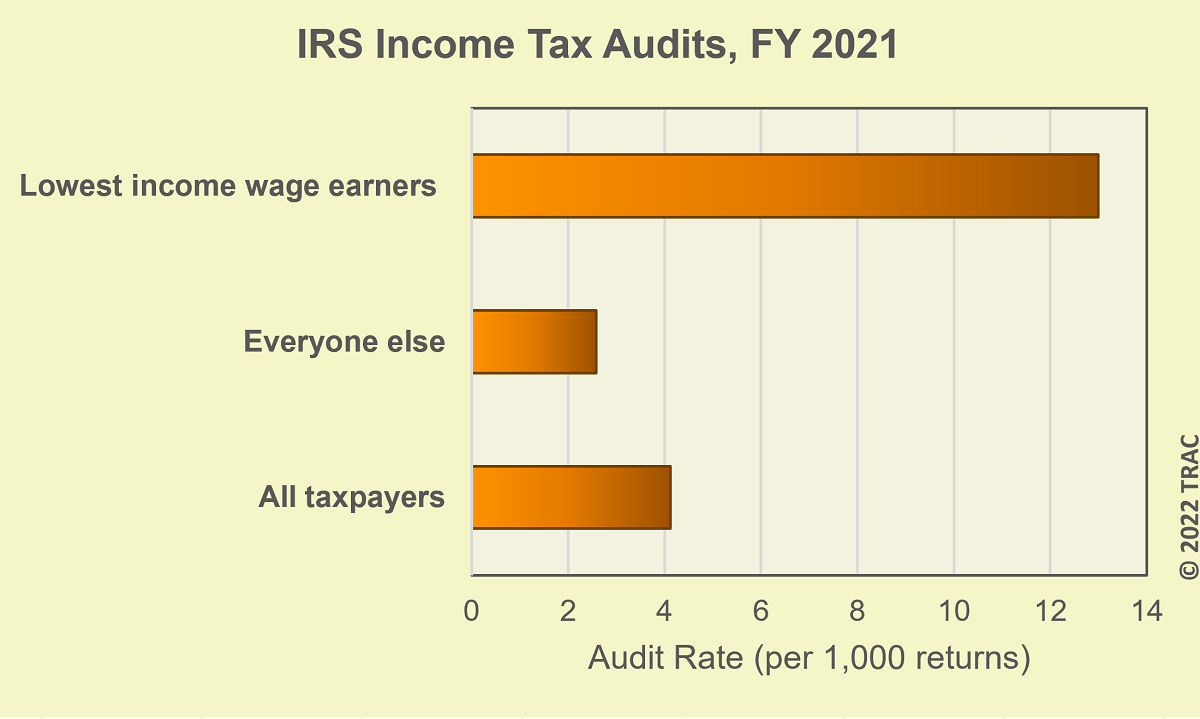

Irs Audits Poorest Families At Five Times The Rate For Everyone Else

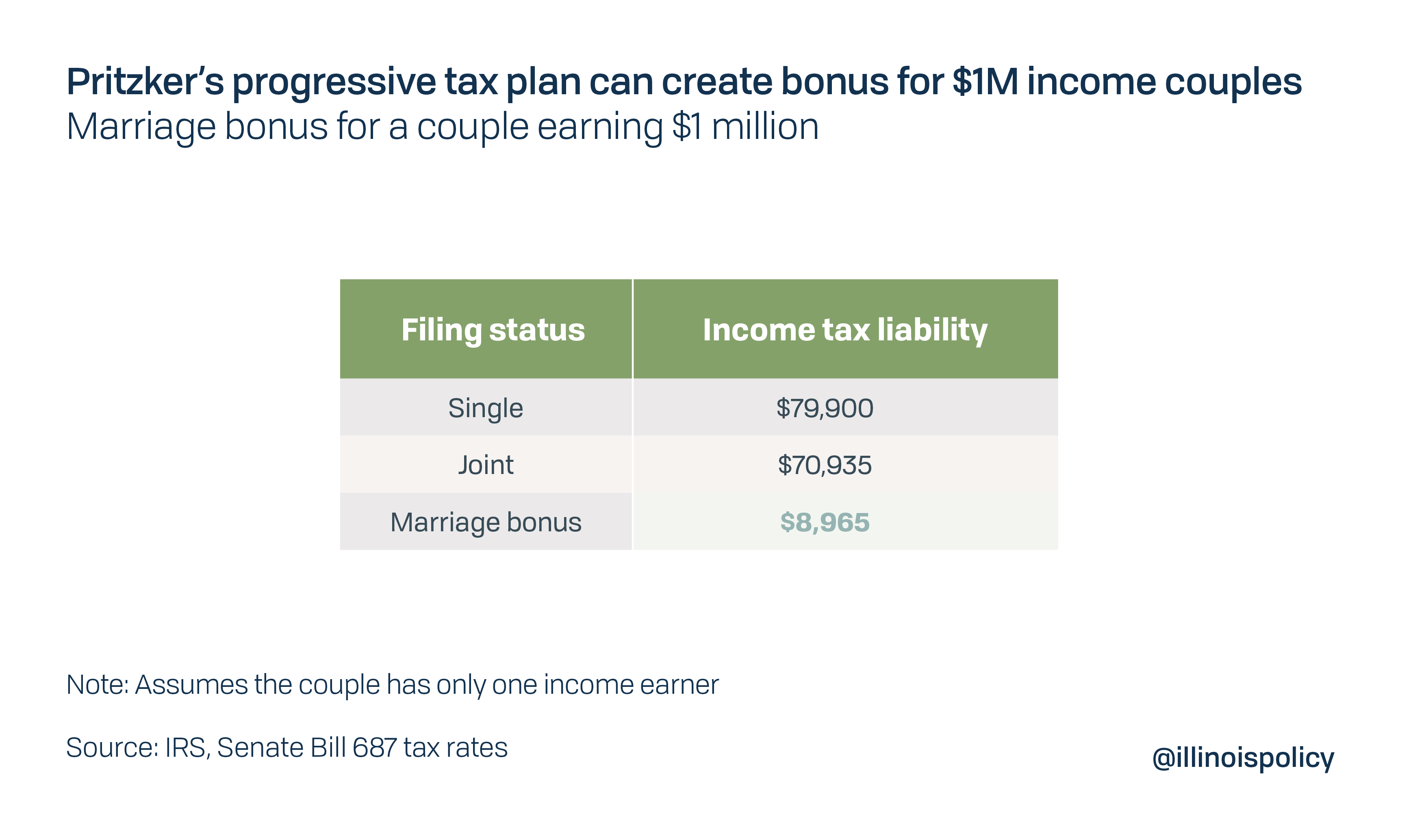

Pritzker Fair Tax Would Hit Over 4 Million Illinoisans With Marriage Penalty Potentially Give Wealthy Couples A Marriage Bonus

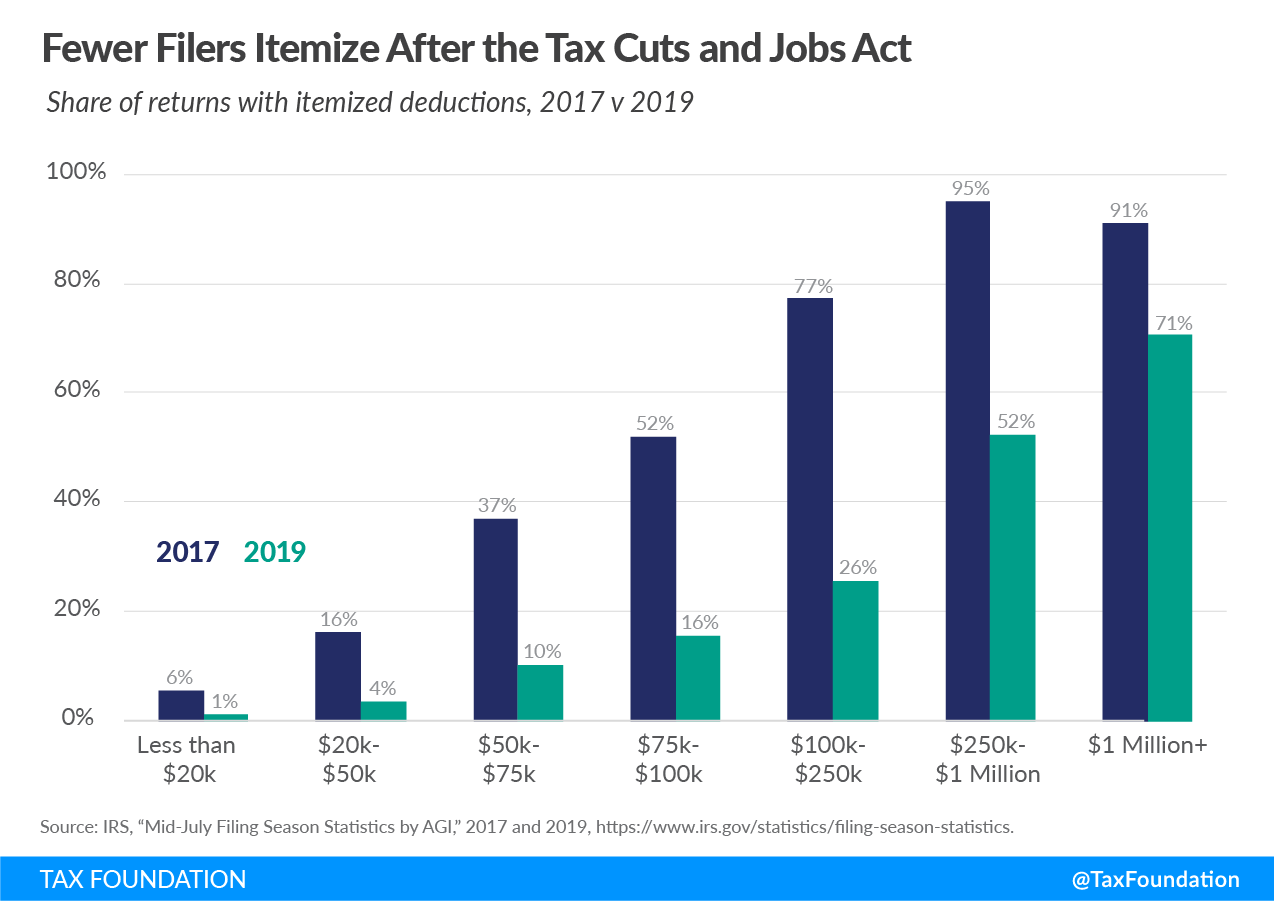

Trump Tax Cuts A Preliminary Look At 2019 Tax Data For Individuals